- Medicaid Copay Amount

- Co Pays For Medicaid Patients

- Medicaid Copays By State

- Medicaid Copay 2020

- Medicaid Copays By State

Member and Providers can access copay and member eligibility information through AVRS by calling 888-483-0793. Molina will return a copay amount for the start date of service if the provider inquires on a date range. No copays will be listed for members on the exemption list. MHD continues to monitor the Centers for Medicare and Medicaid Services (CMS) guidance related to COVID-19 testing and specimen collection. The tables below list the COVID-19 testing and specimen collection procedure codes MO HealthNet currently covers as well as who can bill each code, effective dates, max units, and rates. . Under Medicaid, states are required to provide both inpatient and outpatient hospital services to beneficiaries. For CHIP, all states provide coverage of hospital care for children and pregnant women. Prescription Drugs. Beneficiaries can receive a range of prescription drugs through Medicaid and CHIP. Medicaid Adult Dental Benefits Coverage by State. This document is a companion to the fact sheet, Medicaid Adult Dental Benefits: An Overview, which outlines states’ coverage of dental benefits for adults in Medicaid. It also highlights.

If you're among the 70-million plus Americans that are enrolled in Medicaid, you might have some questions about Medicaid copay.

You may have heard about a copay before, but you're confused about what it means and how it affects your benefits when it comes to medical expenses.

In this article, we'll cover everything you need to know about Medicaid copay. We'll discuss what it is, how it may affect your medical costs, who is exempt from it, and more.

What is a Medicaid copay?

You've enrolled in Medicaid because you know that it provides access to healthcare, improves your health, and reduces your anxiety and stress when it comes to medical expenses.

But having Medicaid doesn't always mean that your expenses will be zero. For some health services, you might be required to pay a fee, which is known as a Medicaid copay.

You can check with your healthcare provider about if your required service involves a copay. If it does, you will pay them directly.

A Medicaid copay is also known as an out-of-pocket cost. These costs are decided at the state level administration of the Medicaid program.

A state can decide that there are going to be copays associated with various medical services that are covered by Medicaid. The service can be either inpatient (when you're formally admitted to the hospital) or outpatient (not admitted to a hospital, like tests or consultations) services.

The copay in each state will vary. It is usually a percentage based on the total cost to the state for your medical service.

The copay or out-of-pocket expense will also typically vary based on your income. Medicaid, as a program is designed to provide care to low-income individuals. So, the lower your income bracket, the more likely that your copay will be minimal, or in some cases non-existent.

Some services, and specific types of people, are generally exempt from Medicaid copay, regardless of the state.

Who is exempt from Medicaid copay?

The detailed exemption from Medicaid copay may vary depending on the state, but in general the following groups are exempt from Medicaid copay.

- Children

- Pregnant women

- People who have reached their quarterly limit of Medicaid copay (more details below)

- People who are terminally ill, including those in hospice

- Medicaid recipients who are living in an institution

- Alaska Natives and American Indians who have ever received a treatment from the Indian Health Service, tribal health programs, or under contract health services referral

- Women in the Breast and Cervical Cancer Treatment Medicaid Program are exempt from alternative out of pocket costs (copays if your income is above FPL)

One critical factor to keep in mind is that you’ll most likely still have access to medical care even if you don’t fall in the exempt group and can’t pay your out-of-pocket expense, especially if you’re severely ill. But if you aren’t exempt, you might be billed for the unpaid copay later on.

What services may require a Medicaid copay?

There are a variety of services that might require a copay, including the following.

- In patient services, where you are officially admitted to the hospital

- Outpatient services, like tests, consultations, clinic appointments, etc.

- If you have to go the emergency room for non-emergency care

- Prescription drugs

What services are exempt from Medicaid copay?

Services that are exempt from a Medicaid copay include the following.

- Emergency services

- Family planning services like contraceptives, sterilizations, birth control methods, etc.

- Pregnancy-related medical services

- Preventative services, like immunizations, screenings, clinical and behavioral interventions, counseling, etc.

How do I know what my Medicaid copay will be?

Before you calculate your copay, you need to figure out if there is an out-of-pocket expense associated with your medical service in the first place.

To find out if there is a copay, you can simply ask your provider.

For example, if you need to fill a prescription, you can ask the pharmacy about a copay. Or, if you need to see your doctor, check with him or her to see if it qualifies as a preventative visit (no copay) or as an outpatient service (may require copay).

If you do find out that there is an expense associated with your visit, then the amount you will owe depends on something known as the FPL, or Federal Poverty Level, and how your income relates to it.

The copay will depend on what state you’re in, and how much the state pays for your medical service, but more on that later.

First, let’s discuss what FPL is, so you can better estimate what your copay expenses might be, based on the type of services you need.

What is the Federal Poverty Level (FPL)?

The Federal Poverty Level (FPL) is a measure of income issued yearly by the Department of Health and Human Services (HHS).

The HHS uses FPL to decide whether you might qualify for medical programs and benefits, including Medicaid, based on your income.

For 2020, here are the numbers to determine Federal Poverty Level.

- For one individual - An annual income of $12,760.

- For a family of 2 people - An annual household income of $17,240.

- For a family of 3 people - An annual household income of $21,720.

- For a family of 4 people - An annual household income of $26,200.

- For a family of 5 people - An annual household income of $30,680.

- For a family of 6 people - An annual household income of $35,160.

- For a family of 7 people - An annual household income of $39,640.

- For a family of 8 people - An annual household income of $44,120.

A note about income, AGI, and MAGI

We listed the incomes based on the number of people in your household that determine whether you fall over or under the Federal Poverty Level (FPL).

But we have to go one step further and briefly describe how the Health and Human Services (HHS) defines income, when it comes to your eligibility for benefits.

This is where AGI and MAGI come in (we promise this is related to Medicaid copay).

AGI - AGI is your adjusted gross income. It is your income that is deemed taxable after you deduct any eligible expenses, etc.

Medicaid Copay Amount

MAGI - When HHS looks at your income, and whether it falls above or below FPL, they do it based on MAGI, which stands for modified adjusted gross income. It is your AGI, plus any of the following:

- Untaxed foreign income

- Social Security benefits that are non-taxable, if any

- Any tax exempt interest you’ve earned in the previous fiscal year

Another few things to note about MAGI.

- For most Medicaid recipients, MAGI and AGI are very close

- If you earn Supplemental Security Income (SSI), it is not included in MAGI

- Your tax return will not have a MAGI line, because it is only calculated by HHS for health benefit purposes

Ok, now that you’ve got an idea of what FPL is, and how it is calculated by HHS, using MAGI, let’s tie it all back into your Medicaid copay.

How is my income linked with my Medicaid copay amount?

In this section, we’ll provide you with an overview of what you can expect your copay to be depending on where you fall in relation to the FPL.

The Medicaid website was last updated in 2013, so it is quite possible that the payments have changed slightly.

Contact your state Medicaid agency for up to date details

Also, since the rules will vary based on your state, you may want to reach out to your state directly for your specific out-of-pocket expenses regulations. Check out the state by state contact information for Medicaid agencies here.

That being said, let’s take a look at your approximate expenses based on income. Remember, income is classified as your MAGI by the HHS.

Your maximum copayments are capped each quarter, or a 3-month period, like “Jan-Feb-Mar”, “Apr-May-Jun”, etc.

The maximum costs below are all calculated on a quarterly basis.

If your income is at 100% FPL or below

Inpatient care - You maximum copay is $75

Outpatient care - $4

Non-emergency use of ER - $8

Preferred prescription drugs - $4

Non-preferred prescription drugs - $8

If your income is between 100-150% FPL

Inpatient care - 10% of what your state pays for the service.

Outpatient care - 10% of what your state pays for the service.

Non-emergency use of ER - $8

Preferred prescription drugs - $4

Non-preferred prescription drugs - $8

If your income is at above 150% FPL

Inpatient care - 20% of what your state pays for the service.

Outpatient care - 20% of what your state pays for the service.

Non-emergency use of ER - No limit, until you’ve reached your 5% family income max per quarter (more below).

Preferred prescription drugs - $4

Non-preferred prescription drugs - 20% of what your state pays for the drugs.

Is there a limit to my Medicaid copay?

As we’ve briefly mentioned a couple of times, there is a maximum limit of 5 percent of your household income per quarter on your Medicaid copay.

Also known as a “cost-sharing limit”, it means that during a quarter (“Jan-Feb-Mar”, “Apr-May-Jun”, etc.), the maximum amount that you may have to pay as your Medicaid copay is 5 percent of the MAGI for your entire household.

If you reach your 5 percent limit, and you need further medical services that typically require a copay, you will continue to receive treatment without having to pay. The copay will reset back to its regular amount in the beginning of the following quarter.

Can I be refused service if I can’t pay my Medicaid copay?

If your income level falls below 100% FPL, the provider can’t refuse you service even if you’re not able to pay your out-of-pocket expense. But you may be billed for your copay at a later date and you’ll be held liable for what you owe.

If your income is above 100% FPL, then the provider might have the option to refuse you care if you aren’t able to pay your copay, depending on your state. If you fall in this category and you have questions, it is best to contact your state Medicaid administration.

If you fall under one of the exempt groups, the medical services provider who accepts Medicaid can never refuse you service.

For all the details on Medicaid’s “cost-sharing” rules, check out Medicaid.gov’s Overview of Cost Sharing and Premium Requirements.

What is the copay for Medicaid prescriptions?

Medicaid prescription copayments vary based on the classification of the prescribed drug in your state.

Your state will classify some drugs as “preferred” and others and “non-preferred”. The state usually differentiates between generic and brand name drugs through these classifications.

The purpose of placing some drugs on a “preferred” list is for the states to be able to promote the drugs that are most cost-effective. If a generic drug is less costly for the state Medicaid, then they want to promote usage of that drug by assigning lower copayments.

We’ve listed what the copayments might be for prescription drugs (both preferred and non-preferred) in the section above. But in general, if your income is above the 150% FPL mark, then your copayments for non-preferred drugs (typically brand named drugs) are going to be high.

There are a few things to keep in mind when it comes to Medicaid copayments for prescription drugs.

- If the state doesn’t specify between generic and brand name for a specific drug, then they are both considered to be “preferred”.

- If your doctor determines that the “preferred” drug will be less effective than its “non-preferred” counterpart, then you will have the smaller copay for both.

Your doctor will know best, but in most cases it makes sense to go with the generic version if it is in the “preferred” category. You will get the same result for a smaller copay.

Co Pays For Medicaid Patients

Medicaid copay for emergency room (ER) visits

Emergency services are exempt from Medicaid copay. But there are situations and reasons why you may visit the ER even when it is not an emergency. Or, you might not be sure if it’s an emergency and visit the ER to be on the safe side.

In such situations, your state has the right to charge a copay for non-emergency use of emergency room (ER) services.

If your income is below 150% of FPL, then your copy will be nominal. But if it is above 150$ FPL, then there is no limit on the copay, and could reach the max for the quarter, which is 5% of your quarterly household income (a significant amount of money).

Medicaid regulations make sure that the hospitals don’t abuse the ability to charge copays. Before they can charge you a copay for using the ER, the hospital has to meet certain conditions.

- They have to conduct an adequate screening to determine that the situation is not actually an emergency.

- They have to inform you about the costs associated with the non emergency service.

- An alternative non-emergency medical provider is available and accessible with the necessary timeframe to provide treatment.

- The copayment of the alternative provider must be less than the use of the emergency room.

- They must provide you the directions and instructions to access the other provider.

- The hospital must also assist in the process of setting up a visit with an alternative provider.

As you can see, the hospital will have to make sure that there is no additional hassle, cost, or risk to your health before they can charge you a copay for non-emergency use of the ER.

Medicaid coverage in the state of New York

There are insurance companies that provide services to Medicare recipients to manage the relationship between the state and the individuals. They make sure that you get all the benefits you’re entitled to and help you navigate the process.

Medicaid Copays By State

In the state of New York, there are quite a few of these providers. With a little research, you will find the one that best suits your needs.

For detailed information, be sure to check out our page on best Medicaid plans in NY.

Final thoughts on Medicaid copay

Medicaid can seem a bit complicated, and it is. There are federal guidelines, and then there are 50 states who have their own guidelines.

Medicaid Copay 2020

With so many guidelines, it might be a bit of a challenge for you as a recipient when you try to find out what services you have access to and what your copay might be, if any.

But if you have a little patience, you will find the information you need, and you’ll be able to take advantage of Medicaid to improve your health and quality of life.

For Medicaid copays, the two best resources remain your medical provider, and state Medicaid agency.

Depending on the state you live in, they might have an up-to-date and well-functioning website. But if not, you can always give them a call and find out all you need about your copay, as well as other Medicaid questions.

Medicaid and CHIP Eligibility, Enrollment, and Cost Sharing Policies as of January 2019: Findings from a 50-State Survey

Tricia Brooks , Lauren Roygardner , and Samantha Artiga Follow @SArtiga2 on Twitter

Published: Mar 27, 2019

Premiums and Cost Sharing

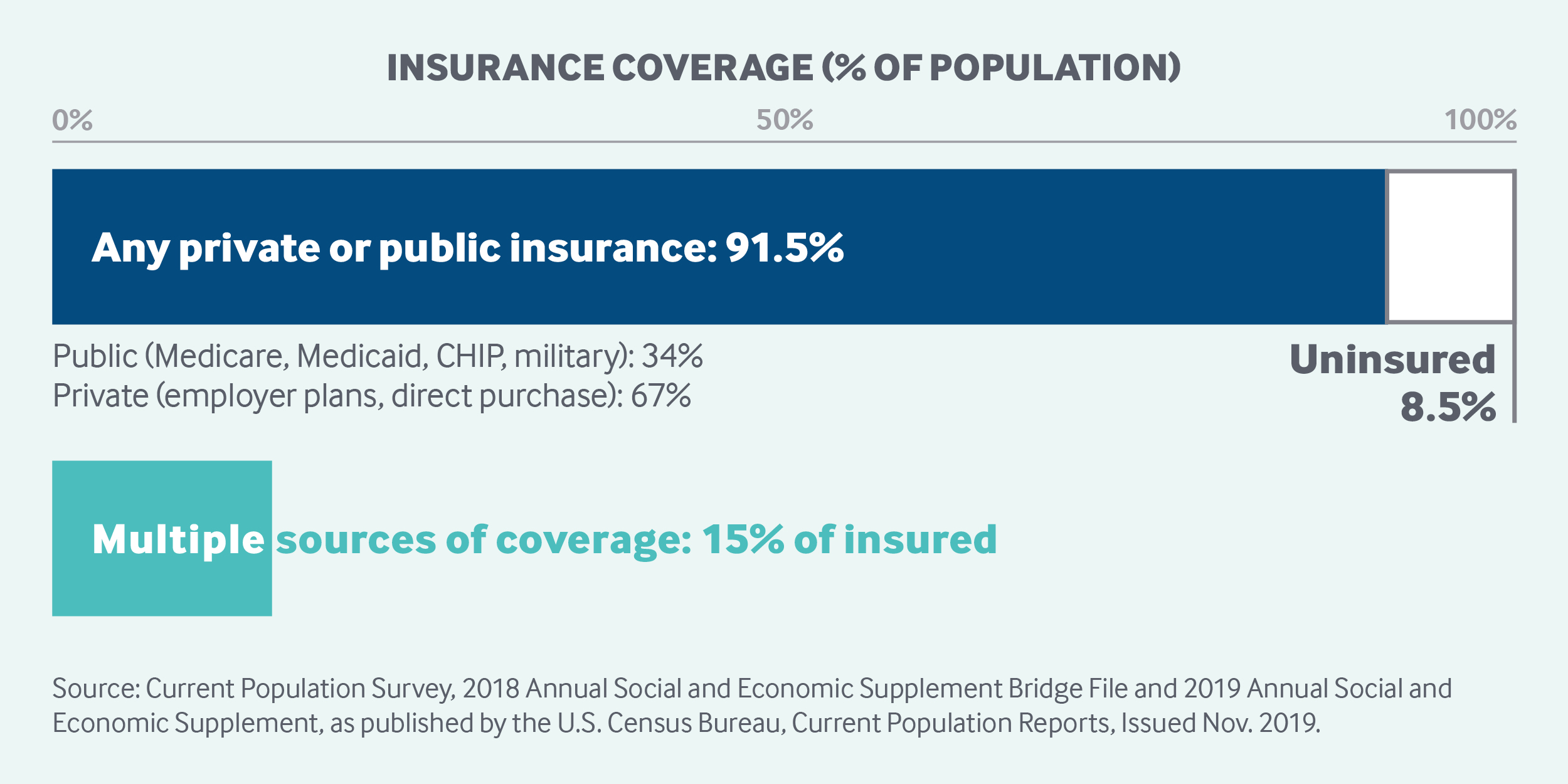

Research shows that premiums serve as a barrier to enrollment for low-income families and copayments can limit utilization of needed health care.1 Federal regulations establish parameters for premiums and cost sharing for Medicaid and CHIP enrollees that reflect their limited ability to pay out-of-pocket health care costs due to their modest incomes. Under these rules, states may not charge premiums in Medicaid for enrollees with incomes less than 150% FPL. However, some states have obtained waivers to impose charges in Medicaid that are not otherwise allowed. Maximum allowable cost sharing varies by type of service and income in Medicaid (Table 1). CHIP programs have more flexibility in regard to premiums and cost sharing, but both Medicaid and CHIP limit total family out-of-pocket costs to no more than 5% of family income.

| Box 1: Medicaid and CHIP Premium and Cost Sharing Rules |

| Premiums in Medicaid. States may charge premiums for children and adults with incomes above 150% FPL. Medicaid enrollees with incomes below 150% FPL may not be charged premiums. Cost Sharing in Medicaid. States may charge cost sharing for adults in Medicaid, but allowable charges vary by income (Table 1). Cost sharing cannot be charged for emergency, family planning, pregnancy-related services in Medicaid, preventive services for children, or for preventive services in Alternative Benefit Plans in Medicaid, which have been defined as essential health benefits. In addition, children with incomes below 133% FPL generally cannot be charged cost sharing. Limit on Out-of-Pocket Costs. Overall, premium and cost sharing amounts for family members enrolled in Medicaid may not exceed 5% of household income. Premiums and Cost Sharing in CHIP. States have somewhat greater flexibility to charge premiums and cost sharing for children covered by CHIP, although there remain limits on the amounts that can be charged, including an overall cap of 5% of household income. |

| Table 1: Allowable Cost Sharing Amounts for Adults in Medicaid by Income | |||

| <100% FPL | 100% – 150% FPL | >150% FPL | |

| Outpatient Services | up to $4 | up to 10% of state cost | up to 20% of state cost |

| Non-Emergency use of ER | up to $8 | up to $8 | No limit |

| Prescription Drugs | Preferred: up to $4 Non-Preferred: up to $8 | Preferred: up to $4 Non-Preferred: up to $8 | Preferred: up to $4 Non-Preferred: up to 20% of state cost |

| Inpatient Services | up to $75 per stay | up to 10% of state cost | up to 20% of state cost |

Premiums and Cost Sharing for Children

The number of states (30) charging premiums or enrollment fees to children in Medicaid/CHIP held steady in 2018 (Figure 19). The stability of premiums, in part, reflects that the extension of CHIP funding also extended the MOE provision for children’s eligibility and enrollment policies. Under the MOE, states may not implement new premiums or increase premiums outside of routine increases that were approved in the state’s plan as of 2010. Premiums and cost sharing are much more prevalent in CHIP than Medicaid, reflecting that the program covers families with more moderate income levels. Only four states charge premiums for children in Medicaid. These premiums are limited to children in CHIP-funded Medicaid expansions and the lowest income level at which they are charged is 160% FPL. Among the 36 separate CHIP programs, four charge annual enrollment fees and 22 impose monthly or quarterly premiums for children; the lowest income at which these charges begin is 133% FPL.

Figure 19: Premiums or Enrollment Fees for Children in Medicaid and CHIP, January 2019

States vary in disenrollment policies related to non-payment of premiums within federal rules designed to minimize gaps in coverage for children. The minimum grace period before canceling coverage for non-payment of premiums is 60 days in Medicaid and 30 days in CHIP. However, 16 of the 22 states charging monthly or quarterly premiums in CHIP provide at least a 60 day grace period. Children who are disenrolled from Medicaid for non-payment of premiums cannot be locked-out of coverage for a period of time as a penalty for non-payment, while separate CHIP programs may establish a lockout period of up to 90 days. Among the 22 states charging monthly or quarterly premiums in CHIP, eight states do not impose lockout periods, including Georgia, which eliminated the practice in 2018. As of January 2019, 14 states maintain lockout periods in CHIP ranging from 1 month to 90 days.

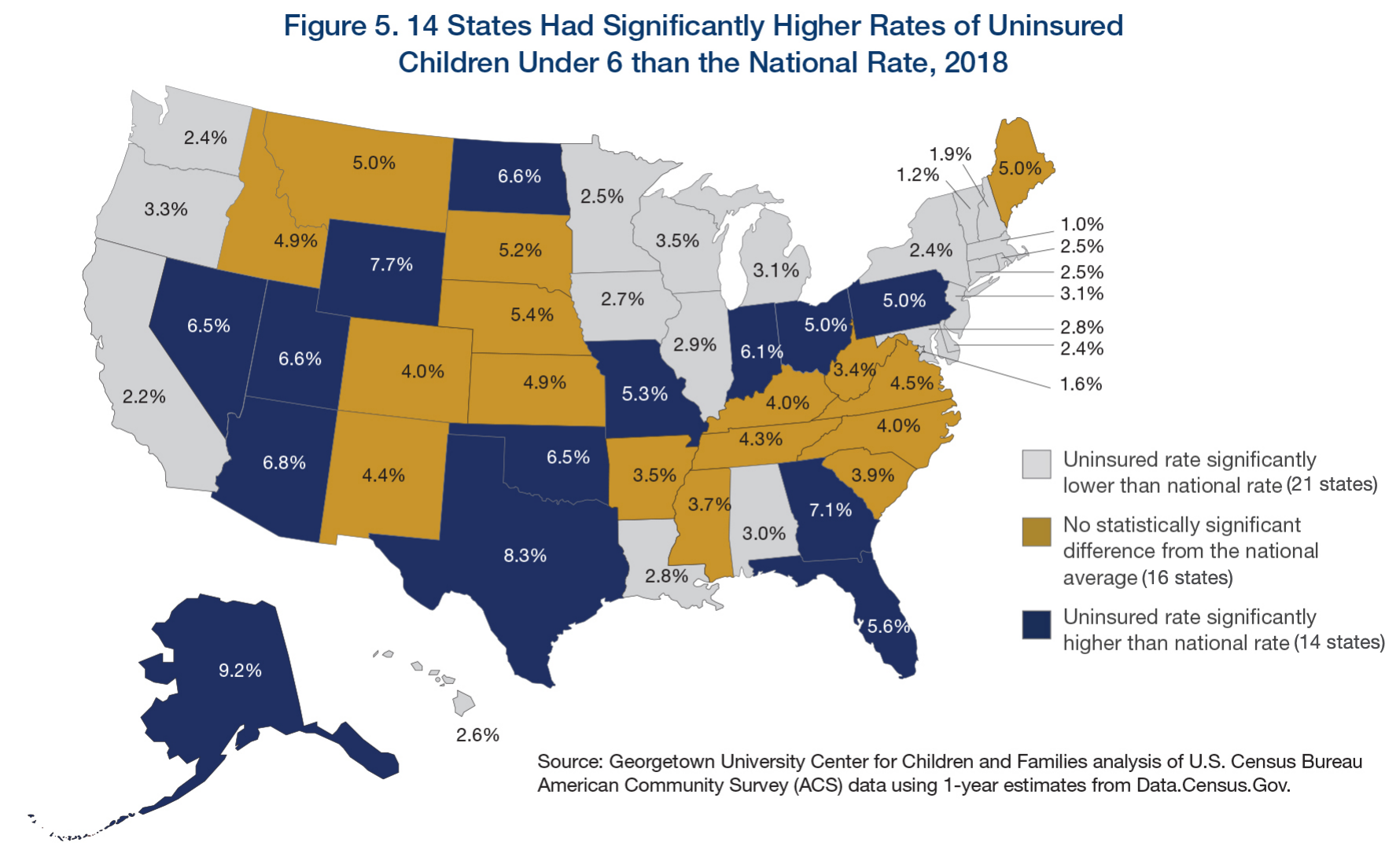

As of January 2019, less than half of the states (23) charge copayments to children in Medicaid and CHIP after Kentucky and New Mexico eliminated children’s copayments. In 2018, New Mexico eliminated its copayments for children, leaving only two states (Tennessee and Wisconsin) that require copayments for children in Medicaid. Kentucky also eliminated copayments for children in its separate CHIP program in 2018, reducing the number of states that impose copayments on children to 23 of 36 states with separate CHIP programs (Figure 20). Only one state (Tennessee) imposes cost sharing below 133% FPL due to long-standing waiver authority. Cost sharing varies by state and service. At 151% FPL, 18 states charge cost sharing for non-preventive physician visits, 14 states charge for an inpatient hospital visit, and 14 charge for generic drugs.

Figure 20: Income at Which Cost Sharing for Children in Medicaid and/or CHIP Begins, January 2019

Premiums and Cost Sharing for Parents and Other Adults

Some states have obtained waivers to charge premiums or monthly contributions for adults in Medicaid that would not otherwise be allowed under federal rules. As of January 2019, five states (Arkansas, Indiana, Iowa, Michigan, and Montana) have implemented premiums or monthly contributions for expansion adults, and, in Indiana, the charges also apply to parents. In 2018, Indiana used waiver authority to add a tobacco surcharge of 50% of the normal monthly contribution if the enrollee has been a tobacco user for the past year. Some of these waivers also allow individuals to be locked out of coverage for a period of time if they are disenrolled due to non-payment and to delay coverage until after the first premium is paid. An additional four states (Arizona, Kentucky, New Mexico, and Wisconsin) have obtained waiver approval to charge premiums or monthly contributions to adults and, in some cases, impose lockout periods or delay coverage, but they were not yet implemented as of January 2019. New Mexico is no longer planning to implement the premiums following a change in state leadership and implementation was on hold in Arizona and Wisconsin, while Kentucky is in the process of preparing for implementation.

As of January 2019, most states charge cost sharing for parents and other adults. A total of 39 states charge copayments for parents eligible for Medicaid under traditional pathways that existed before the ACA (Figure 21). In addition, of the 35 states that cover other adults (including the 34 states that have implemented the ACA Medicaid expansion and Wisconsin, which covers other adults but has not adopted the expansion), 25 charge copayments. The number of states charging copayments to traditional parents has remained generally consistent for several years. Although many states impose the charges on all adult beneficiaries, regardless of income, cost sharing amounts in Medicaid are limited by federal law. Two states made minor adjustments to copayments in 2018, including New Hampshire, which lowered cost sharing amounts for expansion adults to match levels charged for 1931 parents, and Indiana which dropped its copayment of subsequent non-emergency use of the emergency room from $25 to $8.

Figure 21: Number of States with Cost Sharing for Selected Services for Adults, January 2019

Medicaid Copays By State

Tags