COVID-19, Emergency, Health & Finances, Medicaid, Medical Bills, Medicare

Even in normal times, medical debt creates a financial burden for many people. Now, in the midst of the COVID-19 crisis, there are two new medically-related financial concerns to keep in mind. First, the COVID-19 crisis is fundamentally a medical crisis. So, what happens if you or a loved one comes down with the virus or is tested for it? How will those medical expenses be covered? Second, if you are already under financial pressure from a job loss or reduced income, how should you handle your medical bills, even if they aren’t related to COVID-19 at all? Let’s take a closer look at these questions and the issues surrounding them.

CARES Act Provisions

We have been informing our readers of the important provisions of the CARES Act, including: economic impact payments, unemployment benefits, help with housing, and options for retirement account withdrawals. The CARES Act, along with the Families First Coronavirus Response Act (FFCRA), also includes provisions related to medical expenses.

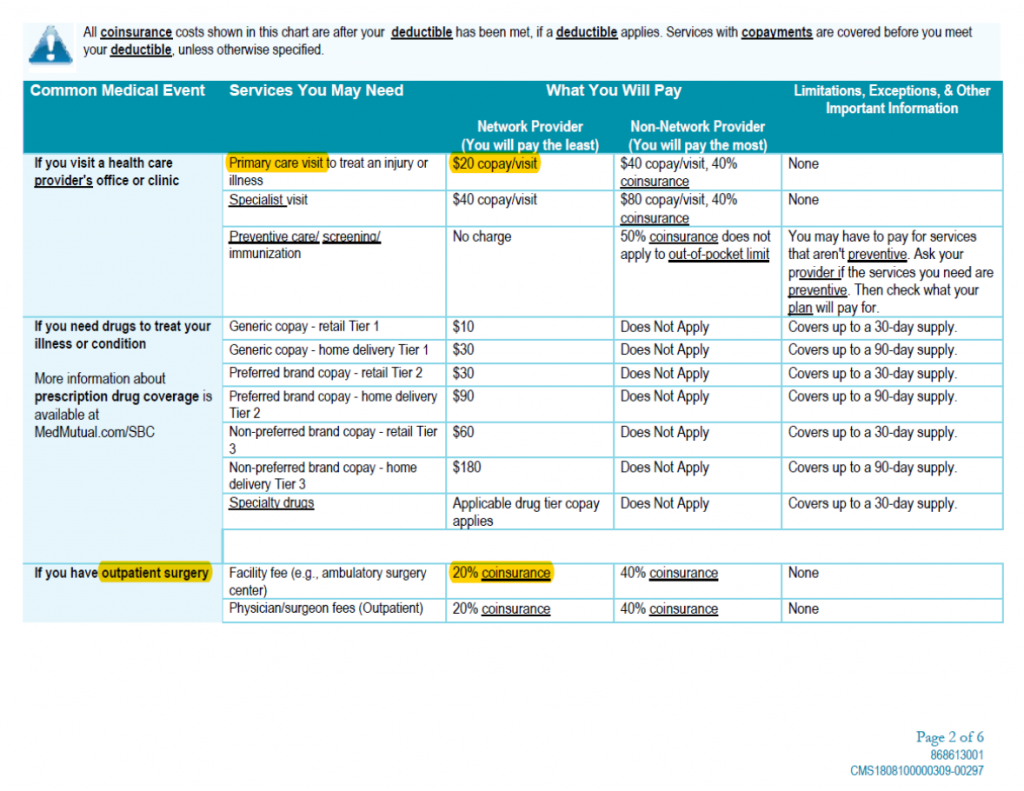

Emergency room: $100 copay (waived if admitted) $100 copay (waived if admitted) 2021 Contributions. Monthly Annual; You only: $38.72 $464.64: You + spouse: $77.44. For example, you may have a $25 copay every time you see your primary care physician, a $10 copay for each monthly medication and a $250 copay for an emergency room visit.

United Healthcare Emergency Room Copay

COVID-19 Expenses

The FFCRA made COVID-19 diagnostic testing free for most insured Americans. This means that your insurer cannot charge you copayments, coinsurance or deductibles related to getting a test for COVID-19. This doesn’t just apply to the test itself, but also covers visits to the doctor both in-person or via telehealth. Note, this applies to ACA-compliant insurance plans offered by your employer or through the exchange. If you have a different type of insurance, your insurer may not cover these costs, so you will need to check.

After the FFCRA, the CARES Act went a step further by creating a broader definition of “covered tests” so that more types of tests would be free. It also provided for additional free medical services. The Act prohibits insurers from charging patients for certain “preventive” services. These include “evidence-based” services designed to prevent COVID-19 infection and immunization (should a vaccine become available).

Emergency Room Copay Aetna

While these laws make testing and preventive treatment affordable, they do not address treatment in response to COVID-19 should you fall ill with the virus. However, insurance companies are stepping up to the plate to waive patients’ costs. Some have entirely waived any costs associated with patients’ treatment. Others are providing more limited assistance, such as waiving the cost of hospital admission. To know what your insurer is offering, review this list published by America’s Health Insurance Plans (AHIP). Keep in mind that like with any other treatment you should try to receive medical care for COVID-19 from an in-network provider. Otherwise, your insurer may not provide the coverage.

Mental Health Coverage

This unprecedented crisis is understandably having an impact on millions of Americans’ mental health. Thankfully, both the CARES Act and insurers have developed some ways to help. As the Kaiser Family Foundation explains, the CARES Act included “a $425 million appropriation for use by the Substance Abuse and Mental Health Services Administration (SAMHSA), in addition to several provisions aimed at expanding coverage for, and availability of, telehealth and other remote care.”

Telehealth appointments can be important opportunities to discuss mental health concerns with a professional. Some insurers are waiving charges for telehealth appointments so that they are free for patients, even if the purpose of the visit is unrelated to COVID-19. Again, check this list from AHIP or call your insurer to learn more. Also, there are some telehealth services offering free care. Some are waiving fees only for visits related to COVID-19 symptoms, while others are waiving fees for all visits.

Impacts on HSAs, FSAs, and HRAs

Normally, if you have a Health Savings Account, Flexible Spending Account, or Health Reimbursement Arrangement, you may use the funds in the account to pay for qualified medical expenses so that the spending is “pre-tax.” However, this typically excludes over-the-counter (OTC) drugs and medicines unless they were prescribed by a doctor. The CARES ACT has changed this requirement, effective January 1, 2020. Now, under the new law, OTC drugs and medicines and menstrual care products are covered as qualified medical expenses. This tool from Connect Your Care identifies eligible expenses.

Managing Other Medical Expenses

If you have medical bills unrelated to COVID-19, you will want to be proactive in managing them, too. Medical debt can be a large financial burden, especially when you may be experiencing other financial difficulties as a result of the pandemic. The NFCC has advice for managing medical debt, and those tips are equally important now.

Be sure to review your bills carefully and get an itemized list of charges. Then, inquire about discounts and payment options, like a write-down or payment plan. You may find that your provider, especially given the ongoing situation, will be more than willing to work with you. Try to avoid taking on a medical credit card if at all possible, and consider having a friend, family member, or even a credit counselor review the bills and advocate for you.